Robots and artificial intelligence are about to change… everything! Cars that drive themselves have arrived. Drones are scary killbots in the sky, but U.S. citizens rarely see them in person. A new generation of robots are arriving in the workplace, and will become teachers, clerks, analysts and even doctors. They may have a few glitches on day one, but within a year of arriving, robots will outperform their human counterparts.

Robots and artificial intelligence are about to change… everything! Cars that drive themselves have arrived. Drones are scary killbots in the sky, but U.S. citizens rarely see them in person. A new generation of robots are arriving in the workplace, and will become teachers, clerks, analysts and even doctors. They may have a few glitches on day one, but within a year of arriving, robots will outperform their human counterparts.

Top US firms may wait and see, but corporations that are struggling for profit, startups seeking breakthrough costs, underfunded school districts, bankrupt municipalities, the military, poor areas without doctors, China’s emerging touches and medical services for the elderly are likely to lead the way. They will demand quality services at a price that only a robot can provide. Transition to a robotic economy will take a decade, but we can expect the labor market to be “disrupted” for another 20 to 50 years, or more. How will you survive until the disruption is over?

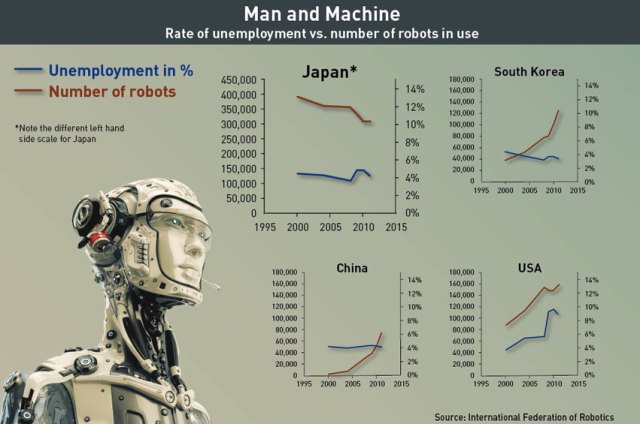

The best predictions point to a loss of as much as half of all U.S. jobs, in as little as 10-20 years. This js a bigger labor disruption than anything before in U.S. history. Farming once employed 70% of U.S. workers, but now employs just 2%. That change took 150 years. Manufacturing was once 70% of the workforce but fell to 8% in just 50 years. In 1980 70% of Chinese workers were farmers. After 35 years, it’s just 29%. This “disruption” represents the elimination of 300 million farm jobs… just using “old” 20th-century mechanization. That’s equal to the entire workforce of the US AND Europe combined. How has China survived this shift in their labor market?

Essentially, China implemented the most impressive social engineering project that the world has ever known. China planned the transition for decades, invested trillions of dollars, built over 500 new cities, installed nearly 2,000 conventional and nuclear power plants, relocated (not always voluntary) hundreds of millions of workers from China’s interior to coastal and river cities, and raised college enrollment from 1.5 million to 20 million.

Yet, even with this staggering amount of effort, the transition has not been without problems. Newly built cities have been left deserted due to changes in planning, there are huge inequities between city and rural pay, in 2015 there were nearly 3,000 strikes and riots, and new workers no longer want to work in factories creating labor shortages. Of course, the US and Europe labor markets were hit by their own disruption as offshoring eliminated millions of jobs. Robots will be even more disruptive. Especially when China itself (the world’s largest buyer of robots) installs millions of robots in its own factories.

In the West, we have been allowed to view some of the disruption in China, especially in factories where iPhones and similar electronics were assembled. China improved working conditions and raised pay. Strikes slowed down, but the increase in pay raised the cost of work in China, compared to competing Asian nations. In order to compete, China needs to improve worker productivity. Which led to China’s “robot initiative”.

To match the cost of countries with lower pay (Vietnam and Cambodia) or higher productivity (South Korea) China plans to install millions of robots. However, by installing these robots would not only costs, it would also more than double productive capacity. Therefore, China needs to either terminate more than half of their 100 million industrial workers, OR they need to encourage the West to outsource more jobs.

If China can cut labor costs in half (or lower), that will attract more work from the West. China also plans to move millions of displaced factory workers into knowledge work jobs into banking, insurance, media and service firms. With these new resources, China can execute on plans to take over these industries around the world. At the same time, the NEW generation of Artificial Intelligence systems will be rolled out to improve productivity in these sectors.

With new worker, and new technology China just may dominate global financial and service markets by the early 2020’s. Did you know that 4 of the top 5 banks in the world are Chinese? Or that China Life is the 3rd largest insurance company in the world? China is already well positioned to dominate the global markets. Recently China even created an alternative to the World Bank, the Asian Infrastructure Investment Bank. China will use this institution to lessen US and European political influence in developing countries, and support their own commercial expansion. This plan requires China to be on the leading edge of robotic automation. As China automate knowledge services, the U.S. and Europe will be pressured to do likewise.

Internationally and domestically, market pressures will accelerate the adoption of robotics and A.I. Similar pressures created the last wave of outsourcing. Decades of corporate outsourcing (2000 – today) created the infrastructure to quickly analyze a position, and then automate it or move it to a new (lower cost) worker. When it’s time to replace a job with a robot, all of the procedures and protocols are already in place. The top consulting firms (IBM, Accenture, Capgemini, TATA, etc.) already have contracts with the Fortune 500 firms. Networks and other technology that will control A.I.s and robots are already up and running. HR and legal long ago agreed on the processes and legalities to eliminate staff. The Robot Revolution will just take over the infrastructure, the “Outsourcing Engine”, speeding job losses until they outpace new job creation. Where does that leave you?

More Training: The most positive articles about the Robot Revolution say that another degree might save you from losing your job. But this just doesn’t ring true. If your job as a financial analyst has been taken over by a robot, getting another degree to be promoted to a higher position in the same line won’t work because – 1) Can you afford to pay-off another school loan?, 2) It will take a couple of years to get a new job, but by then this job might be targeted for a robot takeover, 3) Having a lot of new PhD graduates doesn’t mean that there will be a lot of new Ph.D. jobs.

More education is often a good thing, but not always. The numbers behind a new degree may work for a few jobs, but it requires case by case analysis. More education may not buy more security. Moving into a completely different field might be a more successful strategy for finding a job, but moving from a highly paid financial position to a mid-level healthcare job might provide the same level of compensation. Education may be the answer for some, but not the majority of displaced workers.

Be A Teacher: A growing number of articles tell us to, “Consider a job in training or education.” There are excellent opportunities in education, and we certainly need more good teachers, but the Robot Revolution will create fewer new training positions than these writers expect. In the old model, trainers work with experts to document the how to perform work processes, and then use this documentation to train new workers. For robots, few trainers will be needed. Robots work directly with experts to learn work processes, and then robots will “teach” other robots. Robots are continuous learners, who correct and expand their database of knowledge. Robots then expand into adjacent jobs, with minimal help from trainers. Teach one robot to fill out mortgage applications, and all robots learn the process. Eventually, they learn how to fill out car loan applications, and replicate the information. Finally, they will learn how to approve the applications…. with better results than the humans they replaced.

Perhaps you want to be a trainer or teacher in some other field? Unfortunately, the Robot Revolution is targeting teaching. Robots can individually monitor students, tracking biometric information (eye focus, body language, blink rates) to know if they are paying attention to the materials, adjusting the pace of education for each student, customizing homework and projects to match individual abilities and issues. Humans cannot cost-effectively match the capabilities of a robot teacher. Don’t believe me? Then take it up with Elmo! That’s right, IBM’s WATSON learning system is teaming up with Sesame street to deliver education to young, poor students. In a few years… will the Cookie Monster teach financial modeling?

Climate Change: Two wrongs are not supposed to make a right… but, there are exceptions. Like climate change. Temperatures are rising around the world, water sources are dwindling, coastal cities may drown, finned fish are disappearing, farm productivity is falling behind population growth, fossil fuels are anathema to millennials, and even optimistic environmentalists say we don’t have enough people to fix all of these problems. But when robots take hold and global unemployment rises by hundreds of millions, could this new army of workers be our solution?

Hurricane Sandy caused $70 billion in damage. Katrina cost $125 billion. Obviously, it’s worth paying a lot of money to avoid this magnitude of damage. New York City has a proposal to storm proof sections of the city, at a price of $20 billion. A plan for Jakarta is estimated at $40 billion. Then there is Venice, Mumbai, Naples, Bangkok, Mexico City, and Miami. Think about all of the smaller towns along coastlines. Add to that damage to farms, dwindling water sources, highways and infrastructure. One estimate puts the cost of economic damage for modest global warming (2.5% degrees C) at 0.5% of global GDP, or around $500 billion annually. Fixing the environment is a huge job. Not fixing the environment isn’t an option, unless we are ready to lose city after city as storms and disasters destroy our urban infrastructure.

Crowd Funding: In the past, if you had an idea for an important project (a business, a new product, a service) you would ask a bank or your friends and family for funding. Now, you can raise just about any amount of money, directly from the public. There are about 200 Crowd Funding sites, with more sites being built. Crowdfunding allows you to campaign for funding through social media tools. The biggest crowdfunded project to date is a game, Star Citizen, which has raised $110 million. In 2014 over $30 billion was raised through crowdfunding, and by as soon as 2018 it will surpass $90 billion. Today, Venture Capital (VC) is the money behind emerging technologies and emerging service companies, but crowdfunding is about to surpass VC funding.

Many of the college graduates who are about to be displaced by robots follow a very specific pattern. They graduate from an Ivy League business school, get a corporate job, gain experience, and then try to launch their own business. If they could, most would jump to creating their startup, either earlier in their career or while they are still in college. This is beginning to happen with crowdfunding. Music, games, books, new technology, even projects that can save the world… are all getting funded through crowdfunding. The combination of a global environmental crisis, and the ability for new talent to circumvent traditional employment paths is the best alternative to waiting for a robot to take your corporate job.

Conclusion: The coming Robot Revolution will revolutionize the workplace. The lucky owners of key corporations will see massive new profits as inexpensive robots replace high-cost human labor. This is a frightening scenario, but it is one that America has lived through before. Agricultural jobs went away. Manufacturing jobs went away. Recently, millions of basic corporate jobs (clerks, phone operators, secretaries, typist pools) went away… and will never return.

In another year or two smart robots will move out of the factory and into the corporation, wiping out jobs from chauffer to financial analyst, and then learn how to do the same for lawyers, doctors, and teachers. The infrastructure for replacing large numbers of workers was put in place during recent rounds of outsourcing. The Robot Revolution will re-use the “outsourcing Engine”, vastly accelerating the replacement process, reducing jobs faster than they can be created.

With high paying jobs going away forever, we face the possibility of double-digit unemployment for decades to come. The solution to the labor market may collapse couldn’t be more ironic. The millions who lose their jobs in finance and in knowledge work may find new careers fighting environmental collapse or using crowdfunding to build new technologies and new products that the old sources of funding (banking, venture capitalists, etc.) would be too conservative to back. Will global warming and crowdfunding make up for the gap created by the Robot Revolution? It’s too soon to say if it can offset all of the job losses, but it will certainly soften the impact.

The labor market today is significantly different than it was just a decade ago. Now, we MUST use social media as a part of our job search process. Music stars, software developers, actors, writers and many others live on social media and can’t work without it. The most intelligent and talented young workers will bypass traditional corporate employment and become part of the creative economy… creating new products and services, funding them directly through crowdfunding. Signs of the environmental crisis are mounting, and project to fix the world will be crowdfunded. The Robot Revolution and Global Warming, two of the greatest disruptions to human civilization EVER, may be the only cure for each other. That’s my Niccolls worth for today, and I’m sticking with it!

Do you agree, or do you think there are better options for the coming disruptions to employment? Comment on this blog and let everyone know what you think!

When does a buzzword become a technology? It’s hard exactly, but “Subscription” is a great example. It started as a simple idea. Software sales groups spend a lot of time and money chasing after customers. They want customers to buy the latest version of software, but the cost and effort to buy and install software are often too much for too little benefit. Even worse, the customers who invest the least, end up with the most obsolete hardware and software and require the most support. Maybe they need to squeeze another year out of obsolete equipment. Either way, these customers consume the most resources and pay developers the fewest fees. A subscription/cloud solution could solve this problem! Software would be up to date, and the sales revenue from updates would be more predictable! That’s not a bad goal, but it could create changes that will disrupt the Tech sector. Let’s dive in and go through the details!

When does a buzzword become a technology? It’s hard exactly, but “Subscription” is a great example. It started as a simple idea. Software sales groups spend a lot of time and money chasing after customers. They want customers to buy the latest version of software, but the cost and effort to buy and install software are often too much for too little benefit. Even worse, the customers who invest the least, end up with the most obsolete hardware and software and require the most support. Maybe they need to squeeze another year out of obsolete equipment. Either way, these customers consume the most resources and pay developers the fewest fees. A subscription/cloud solution could solve this problem! Software would be up to date, and the sales revenue from updates would be more predictable! That’s not a bad goal, but it could create changes that will disrupt the Tech sector. Let’s dive in and go through the details!

The beginning of the end. Remember all of the old “B” sci-fi movies from the 50s that either started or ended that way? Usually with a shot of an atomic bomb exploding in the background. Sir Winston Churchill had a much better way of saying it. “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” UBER has reached the end of the beginning. The world’s most heavily valued taxi service is about to become the world’s most heavily valued robotics firm.

The beginning of the end. Remember all of the old “B” sci-fi movies from the 50s that either started or ended that way? Usually with a shot of an atomic bomb exploding in the background. Sir Winston Churchill had a much better way of saying it. “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.” UBER has reached the end of the beginning. The world’s most heavily valued taxi service is about to become the world’s most heavily valued robotics firm. When technology changes, early adopters become risk takers. If you sit and wait, you will eventually know which technologies win or are even worth pursuing. Early adopters either see something that the rest of us have missed, or they truly believe in a new technology. But what do the early adopters see that we’ve missed? And when do early adopters throw in the towel when they’ve clearly backed the wrong horse?

When technology changes, early adopters become risk takers. If you sit and wait, you will eventually know which technologies win or are even worth pursuing. Early adopters either see something that the rest of us have missed, or they truly believe in a new technology. But what do the early adopters see that we’ve missed? And when do early adopters throw in the towel when they’ve clearly backed the wrong horse?

I hope everyone at LegalTech had a great time, there certainly was a lot to see! While I like to do an overview of new technology every year, this year I wanted to focus on answering a big question about legal technology. Legal pretty much developed all of the modern document management systems we use today. Then it was legal that came up with the automated ediscovery and continuous learning software. For years, legal led the world in developing technology that could take over the work performed by entry-level associates, moving basic knowledge work from humans to machines. Now, the rest of the world is catching up quickly.

I hope everyone at LegalTech had a great time, there certainly was a lot to see! While I like to do an overview of new technology every year, this year I wanted to focus on answering a big question about legal technology. Legal pretty much developed all of the modern document management systems we use today. Then it was legal that came up with the automated ediscovery and continuous learning software. For years, legal led the world in developing technology that could take over the work performed by entry-level associates, moving basic knowledge work from humans to machines. Now, the rest of the world is catching up quickly. In our last blog, we looked into how robots and learning machines are positioned to take over professional jobs: doctors, lawyers, and corporate MBA jobs. Advances in learning systems allow robots to learn the same way humans do, by reading and by doing. Advanced robots are paired with experts. The expert gives the robot work assignments and gives feedback on the work. All in plain English (or French, or German, depending on the expert). Just like an apprentice, the robot’s work improves with every assignment and soon looks like the work of the expert. But is it not just learning to copy a specific document, it is truly learning about what makes an expert, an expert.

In our last blog, we looked into how robots and learning machines are positioned to take over professional jobs: doctors, lawyers, and corporate MBA jobs. Advances in learning systems allow robots to learn the same way humans do, by reading and by doing. Advanced robots are paired with experts. The expert gives the robot work assignments and gives feedback on the work. All in plain English (or French, or German, depending on the expert). Just like an apprentice, the robot’s work improves with every assignment and soon looks like the work of the expert. But is it not just learning to copy a specific document, it is truly learning about what makes an expert, an expert. That’s impressive! But winning a good game isn’t the same as working in a real job. That’s why

That’s impressive! But winning a good game isn’t the same as working in a real job. That’s why  The fourth wave is almost here, and it will indeed sweep away these jobs. It will happen so swiftly that we don’t be able to replace these jobs as quickly as they disappear. Some pundits say that at least some can soften the impact by getting yet another degree, and maybe yet another a few years later. That might work for a small number of workers, but for a generation that has been crushed by the cost of student loans, that might just buy a little time without improving their lives, or they financial situations. There is, however, one possible way to escape the robot revolution.

The fourth wave is almost here, and it will indeed sweep away these jobs. It will happen so swiftly that we don’t be able to replace these jobs as quickly as they disappear. Some pundits say that at least some can soften the impact by getting yet another degree, and maybe yet another a few years later. That might work for a small number of workers, but for a generation that has been crushed by the cost of student loans, that might just buy a little time without improving their lives, or they financial situations. There is, however, one possible way to escape the robot revolution.