Automation is all around us. Technologies that displace human have become pervasive, and so SUCCESSFUL, that we barely notice them. Parking meters were part of the urban landscape for nearly a century, with downtown areas packed these mechanical marvels. Today a single automated “station” manages parking spaces for the entire block. Coins are gone, and you pay with a credit card. You probably never noticed them, but an invisible army of “coin collectors” quietly collected coins from meters, and then just as quietly disappeared as card swipes replaced coins and tokens.

Automation is all around us. Technologies that displace human have become pervasive, and so SUCCESSFUL, that we barely notice them. Parking meters were part of the urban landscape for nearly a century, with downtown areas packed these mechanical marvels. Today a single automated “station” manages parking spaces for the entire block. Coins are gone, and you pay with a credit card. You probably never noticed them, but an invisible army of “coin collectors” quietly collected coins from meters, and then just as quietly disappeared as card swipes replaced coins and tokens.

Soon, card readers will disappear as payment stations and kiosks are replaced by smartphone apps. Coin collectors and many other nearly invisible workers have disappeared, but few tears have been shed for these low level, low paying and… let’s face it… boring jobs. High-end jobs that require education, experience, and critical thinking have been safe from automation, but not for much longer!

The reality is that high paying jobs are being targeted for replacement by the latest generation of robots and learning systems. In the last wave of US job losses, outsourcing and automation worked together to reduce the number of service and support positions. Many of these jobs were performed by individuals who spent months or years learning how to perform their jobs, but which nonetheless were repetitive and followed simple rules.

Outsourcers learned how to document the procedures needed to accomplish the work, and then transferred this knowledge to new staff offshore, or created software applications that performed some or all of the work. While we believe that this process of identifying, automating and moving work is a new challenge to the job market, it is, in fact, a process that has been going on in America for at least two centuries. Using knowledge transfer to move that work to machines or to a cheaper labor market has only recently been called “outsourcing”, “workforce augmentation” and “transformation”. We used to just call it, “progress”.

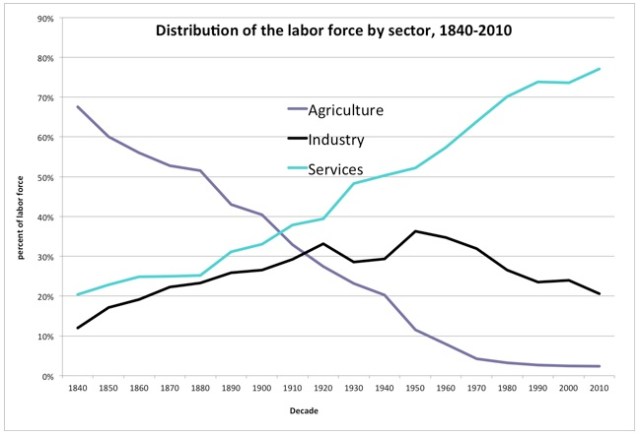

PROGRESS?: From just before the Civil war until the start of the 20th century, America’s economy was agricultural. Human and animal muscles tamed the land. The age of mechanization replaced human muscle with machine power, such as tractors and harvesters. Plow horses have completely disappeared, and computers are now part of modern farming. A century of progress in agriculture has resulted in just 1-2% of Americans working on farms. Farming jobs were replaced by factory jobs.

By 1965, 53% of Americans were employed in factories. For most of America, especially southern states, this progress meant a better standard of living and kick-started the next economic revolution… the service economy. But as the service economy rose, history repeated itself as employment in manufacturing was hollowed out by automation (and outsourcing). Factory workers are now just 8% of the workforce, and will eventually settle in at the same 1-2% as agriculture. Now the service economy is evolving into the data economy, and old service jobs are being outsourced and automated.

By 1965, 53% of Americans were employed in factories. For most of America, especially southern states, this progress meant a better standard of living and kick-started the next economic revolution… the service economy. But as the service economy rose, history repeated itself as employment in manufacturing was hollowed out by automation (and outsourcing). Factory workers are now just 8% of the workforce, and will eventually settle in at the same 1-2% as agriculture. Now the service economy is evolving into the data economy, and old service jobs are being outsourced and automated.

This last wave of outsourcing, at the start of the 21st century, was driven by the falling costs of telecommunications and computers. Low cost allowed all corporate workers to have computers. Telecommunications became equally inexpensive, allowing computers all over the world to be linked together, making it possible for computer work computer to be performed anywhere. Including locations where the cost of labor was much, much lower. The Internet cheaply connected the world and made virtual offices around the world practical and easy to implement.

THE OUTSOURCING ENGINE: Now that all of these locations and computers were linked through the global Internet, an “outsourcing engine” was forming. With high-cost jobs at one end and low-cost labor markets and automation at the other end, the difference or gradient between the two sides would draw jobs from the high end and move it to the low end. The greater the gradient the stronger the draw and the faster the jobs move. At first, work moved from cities to suburbs, then from Northern states to Southern states, and eventually from the US to offshore.

This vast outsourcing engine has continued to grow and gain sophistication, moving millions of jobs offshore. Once core functions of specific positions were understood, outsourcers would look for their next opportunity. Outsourcers learned how to perform vertical drilling into onshore jobs… expanding successful outsourcing programs into: related positions, more senior positions, equivalent positions in different firms, similar positions in different industries, etc. Six Sigma, Lean and Continuous Improvement techniques standardized and simplified work, and new layers of software boosted productivity. Outsourcers talk about this ongoing churning of the outsourcing engine as the “new normal”. Tomorrow’s outsourcing will be very much like today, just bigger.

Until recently, the outsourcing engine appeared to be slowing. A lot of positions have been moved, and wages have been rising at the other end of the engine, reducing the “gradient” and slowing the engine. Cambodia and Vietnam have started to compete with “expensive” China, charging only 15% to 30% of the rates China charges. Knowledge work has moved from India’s big cities to the suburbs, and to other Asian locations. But nothing slows down outsourcing for long.

THE ROBOT REVOLUTION: The outsourcing engine will continue to expand, and is about to go into high gear with a new breakthrough. In the second decade of the 21st century, a new generation of robots is arriving. True robots and thinking machines that are able to learn from experience and develop answers and ideas that they were not developed by their programmers. These are the grandchildren of automation. Some can even write their own programming and fix programming bugs. Through a new technology called Natural Language Programming, they know how to read and write. Machines that can read and write, that can learn from their mistakes have many of the same attributes as the individuals who work in corporate America’s most highly paid jobs.

New robots learn their work by working with an expert. An expert might send an example of a report to a robot. The robot will read the report, determine where the information in the report came from, learn how to imitate the “voice” of the document (i.e. the Wall Street Journal has a different language pattern than a Dr. Seuss book), and other logic that defines the document. It then creates a new report and provides it to the expert, who then returns it to the robot with corrections. This cycle repeats until the work is acceptable. This is the same process that a human, especially a trainee, follows when they learn how to perform their job.

PROGRAMMING vs. LEARNING: There are, however, differences between robots and humans. A human might be given a week to complete a complex project, and then many additional projects to gain expertise in this function. That takes months or years. A robot will complete the first report in a few minutes (eventually seconds). While the robot will be fast, the training cycle will initially be slow because the human expert needs time to analyze results and select new work to refine and build the robot’s capabilities.

Once a single robot learns how to perform a job, the training cycle is eliminated for all future robots. Instead, you just copy the programming… the learning… that he robot developed. All new robots will know the same things and act exactly the same way as every other robot. Robots have no egos to manage or divas to work with. Robots have no special needs and no after work interests to compete with. Every new robot worker is as good as the best worker you’ve ever had, and all robots automatically share new data and best practices with every other worker.

Given time, new technologies create new jobs

Consider the magnitude of changes that robotic workers will bring. When corporations needed computers, they also needed computer support and programmers. It took decades for colleges and corporate HR to catch up. Training departments had to be created to ensure that skills were kept current and corporations could use the latest programming languages and technology. As the number and the size of programming teams grew, managers had to be trained in managing and developing teams and needed to follow HR directives on how to rate performance and award bonuses. Recruiting, training, and other functions would go away. New “workers” don’t need new training teams. The quality of your staff continually rises, and the cost of new robots continually falls. Perhaps most importantly, the techniques and skills developed by the robots belong to the corporation and not the worker. Today, workers who learn more get paid more. Those that are the very best, get bigger bonuses. If they win industry awards, that person (or the entire team) will demand raises and promotions. Robots don’t make demands.

When will this new technology connect to the outsourcing engine? It’s happening right now. The earliest of these learning systems started in the legal field. Corporate lawsuits involve a massive number of documents, sometimes in the millions. The process of onboarding a large number of lawyers and determining which document are relevant to the lawsuit is called a document review. A big case could involve hundreds of lawyers reading every document, taking months or years to complete the review.

BETTER, FASTER, CHEAPER: Alternatively, if you just load these files into a database, robotic document review software can take the criteria for the documents needed for the case, go through a quick learning period (a few days) and then review millions of document in a matter of hours, if not minutes. The process of learning the rules to a document review (or any other task) is called NLP, or Natural Language Programming. Basically, the expert (in this case the head of the review) shows the review system some sample documents that look like what they want. The robot identifies some documents, and after a bit of back and forth, the robot reliably identifies the right documents.

NLP is just the latest in a long line of technical advancements in document review, but if it is fully utilized the cost of a review would be conservatively reduced by 50%-75% and the turnaround time would be dramatically reduced.

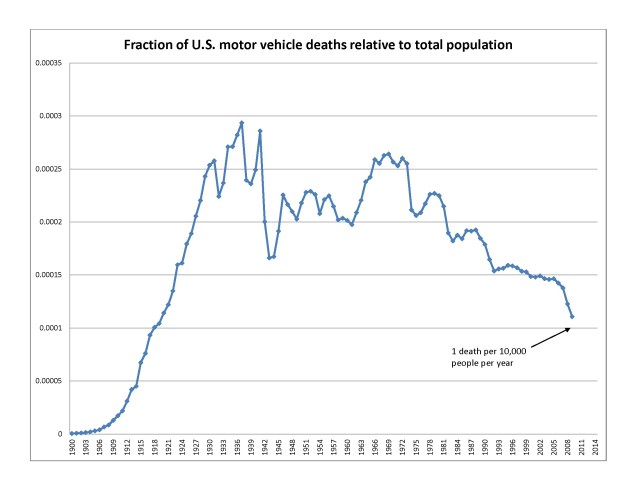

Advanced general purpose learning systems that use NLP are appearing everywhere. Cars are becoming autonomous. Autonomous cars drive themselves. Most of the high-end cars sold in 2016 will have some or all of the features of autonomy. It may be another year or two before they use the term “fully autonomous”, but drivers will start handing over control of their cars this year. Who wouldn’t enjoy taking their eyes off the road in a traffic jam?

Driving a car may is not directly related to many corporate jobs, but when millions of robots start talking to each other to learn new driving rules, understand laws in different states, and adjust to changing weather conditions… learning machines will evolve at lightning speed.

Newspapers and text media have used robot reporters to write sports stories, financial updates, and other materials. Robots have autonomously performed surgery, and even independently performed research studies. Robots that can learn and adapt have arrived.

INSERT ROBOT HERE: To determine where these robots will work, let’s look at how outsourcers identify and prioritize projects. First they analyze a corporation to identify jobs that are performed by many people, even if the positions have different names. Next they look at the current cost and the replacement cost (offshore or automated). If these first two criteria yield compelling numbers, then you would choose the simplest of these positions to transfer. An entry level position instead of a senior position, or if there are many similar positions, the one that is the best documented. You will still need to add documentation, work out processes and identify tacit knowledge that is always overlooked, but good documentation gives you a good head start.

Does a financial analyst even need arms?

In the coming robotic revolution, the best place to start (entry level, well documented, and high paying) will be the positions filled by graduate MBA’s. Graduates with MBA’s and professional degrees (lawyers, doctors, accountants, consultants, etc.) have built their own “onboarding engine”. Just as outsourcing has an engine that is pumping jobs offshore, these professional schools have an engine that pumps graduate students into corporations. For many decades, corporations work directly with professional schools to ensure that their graduates fit into “development tracks” in the corporation.

For example, business colleges graduate MBA’s that are trained to become financial analysts. MBA programs train to the skills that their corporate customers want. Corporations go to their favorite campuses to recruit. New MBA programs are constantly looking for ways to tweak their program to get included in these recruiting efforts. The “onboarding engine” is already connected to one part of the corporation, while the “outsourcing engine” is connected to other areas of the corporation.

Once the outsourcing engine is upgraded with the right robotics to financial analysts work, you just need to let the two engines connect. In a couple of years, we can expect the first entry level MBA robot. At first, it will support, then replace many of the entry level MBA’s. Then it will start to move up the value chain to more and more senior versions of these jobs. Once the first robot is ready for any job description, it can be replicated across the entire army of robot “knowledge workers”. Within the next 5 years, we can expect that much if not all of the work that is done by rooms full of MBA’s can be performed by robotic learning machines.

HOW HIGH CAN YOU COUNT: How many jobs will be affected? Just as with farming and manufacturing, it takes time to go from the 1st robot until the field has matured. Farming took a century, and manufacturing took half that time. The last wave of service outsourcing took about 20 years. So, we should expect the move to a data economy will happen in 10 or 12 years, and it will pass the half way mark in 5 years or less. How many jobs will be affected? Keep in mind that when MBA graduate jobs go away, so too will jobs in HR and training. When the number of MBA’s shrinks, so too will the number of administrators and other support personnel. Conservatively, 60 million jobs (40% of US jobs) will be impacted, with some jobs permanently disappearing and others evolving into new positions.

Whew! We started with collecting coins from parking meters and we end with a devastating tidal wave of change that will sweep away some of the highest paying jobs today. You may think that this is a fantastic scenario, yet you can draw a straight line from farms, to factories, to service firms and follow it to our data economy and modern knowledge work. The only variable that changes is the speed at which each of these stages transfers transfer jobs. Of course, in the last stage jobs were largely transferred offshore and in the next stage work will be transferred to robots and away from humans.

Past pundits have said that we’ve reached the end of outsourcing. And then something a bit more complex is outsourced, or a new (lower cost)location become an outsourcing hotspot. In this coming wave, so much of the groundwork is already complete, and the technology is capable of moving so much faster, that outsourcing will cause many times the disruption that we have seen so far. Get ready for a rough ride as robots replace MBA’s in corporations around the world. But don’t worry, that doesn’t mean that America’s most privileged graduates will be unemployed. In our next blog, say “Hello!” to the Creative Economy! At least, that’s my Niccolls worth for today!

When you sell your business, you will talk to friends and mentors and ask for their opinions. You’ll want to know if they agree with your decisions. You’ll probably ask, “What do you think is my business worth?” In a previous blog we saw that valuations are based on measurable financial data, and adjusted through a “multiplier” (that varies by industry). That, plus the value of your assets… if any… provides a pretty straightforward valuation. Alternatively, you can find firms that are similar to your that were recently sold. But, when you look closer apparently similar firms sold for different prices. How can this happen? Aren’t valuations “scientific”, aren’t three formulas that are used to determine value? As you will see, there are formulas, but there is more to valuation than just financial data!

When you sell your business, you will talk to friends and mentors and ask for their opinions. You’ll want to know if they agree with your decisions. You’ll probably ask, “What do you think is my business worth?” In a previous blog we saw that valuations are based on measurable financial data, and adjusted through a “multiplier” (that varies by industry). That, plus the value of your assets… if any… provides a pretty straightforward valuation. Alternatively, you can find firms that are similar to your that were recently sold. But, when you look closer apparently similar firms sold for different prices. How can this happen? Aren’t valuations “scientific”, aren’t three formulas that are used to determine value? As you will see, there are formulas, but there is more to valuation than just financial data!

ould be worth millions of dollars. Once you remove physical assets, the ratio moves a lot clos

ould be worth millions of dollars. Once you remove physical assets, the ratio moves a lot clos

why Uber is on the prowl to find resources that know robotics. The prestigious Carnegie Mellon University’s “National Robotics Engineering Center” has been bought out (or hired away) by Uber. Uber NEEDS robotic cars, and they have an enormous amount of cash to buy whatever it takes to keep up their momentum. Remember, robots don’t have rights, and they never go on strike…

why Uber is on the prowl to find resources that know robotics. The prestigious Carnegie Mellon University’s “National Robotics Engineering Center” has been bought out (or hired away) by Uber. Uber NEEDS robotic cars, and they have an enormous amount of cash to buy whatever it takes to keep up their momentum. Remember, robots don’t have rights, and they never go on strike…